PPSR Lease Losses

Posted: 10 June 2019

When the Personal Property Securities Register (the PPSR) was established in 1999, most businesses were quick to catch on that it was a good idea to register security over goods that were sold under a line of credit. What wasn’t so easily recognised is that the register was designed to also capture leases of goods that are indefinite or extend past one year.

Businesses that frequently lease goods, or provide hire purchase arrangements, with the intention of remaining the true owner of the goods leased, do not always register their lease on the PPSR. They believe it to be an effective means of security that they retain legal ownership of the goods. This ownership can, however, be defeated by a registered interest on the PPSR and result in significant loss to their business.

Good intentions

The PPSR was designed to increase the transparency of lending and to be a source of truth for all financiers, purchasers and lessees. Where entities purchase goods and require credit, or financing, the financier or seller can register that interest on the PPSR. This puts other potential financiers (or purchasers) on notice that those goods are financed or leased by the entity trying to sell, or use, those goods for additional finance.

Don’t court risk

What then happens, however, when a business has leased an impressive work yard of equipment? If this is not recorded on the PPSR, a future financier has no reason to believe that the property isn’t truly owned by the entity asking for credit. The right to register on the PPSR therefore extends to goods that are leased for greater than one year; this means that future financiers are put on notice that the collateral being put forward is not truly the property of the entity asking for credit.

When goods are leased for an indefinite period, or greater than one year, the lease should be registered on the PPSR. This ensures future financiers of the lessee do not include the leased property when considering the assets of the lessee, so that in the instance of liquidation the leased goods are protected.

An example

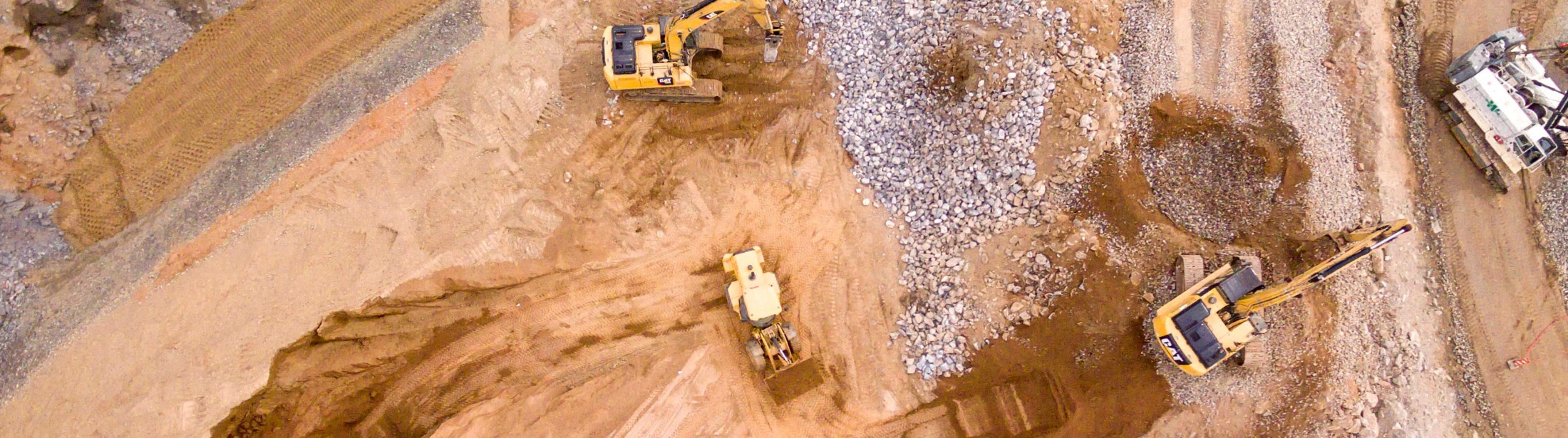

Your company has leased four diggers for 18 months to XYZ Construction Ltd. As you intend to remain the owner of those diggers, you do not register them on the PPSR. XYZ later approaches a bank for a loan. The bank checks all XYZ’s assets (including your diggers), does not see them registered on the PPSR and reasonably concludes they are the property of XYZ. The bank then lends them $1 million. Subsequently, XYZ goes into liquidation and your diggers are seized by the liquidators as assets to be sold to pay back the company’s bank debt. Even though you are the true owner of the diggers, the bank had the first registered interest on the PPSR and defeated your ownership.

However, if you had registered the lease on the PPSR, then the bank (and subsequently the liquidator) would have been on notice that the diggers were not the property of XYZ, and would not be entitled to take your diggers to recover their losses.

Make sure you register

The PPSR will continue to penalise businesses that do not register an interest in property – being credit, leases or hire purchase arrangements – by putting their priority behind those of registered parties.

If your business leases goods for a period greater than one year, and you do not register your lease on the PPSR, then those goods are at significant risk of being lost should any of your lessees become insolvent.

If you’re unsure if your leases or hire purchase arrangements fall under these circumstances, please don’t hesitate to contact us.

DISCLAIMER: All the information published in the Property eSpeaking, Commercial eSpeaking, Trust eSpeaking, Rural eSpeaking, and Fineprint newsletters is true and accurate to the best of the authors’ knowledge. It should not be a substitute for legal advice. No liability is assumed by the authors or publisher for losses suffered by any person or organisation relying directly or indirectly on this article. Views expressed are those of individual authors, and do not necessarily reflect the view of this firm. Articles appearing in Property eSpeaking, Commercial eSpeaking, Trust eSpeaking, and Fineprint may be reproduced with prior approval from the editor and credit given to the source. Copyright, NZ LAW Limited, 2019. Editor: Adrienne Olsen. E-mail: [email protected]. Ph: 029 286 3650 or 04 496 5513.